The allure of Bitcoin, the grandfather of cryptocurrencies, continues to captivate investors and tech enthusiasts alike. Its decentralized nature, scarcity, and potential for significant returns have fueled a global mining industry. However, understanding the intricacies of Bitcoin mining costs and profitability is crucial for anyone venturing into this competitive landscape. Gone are the days when a simple desktop computer could yield substantial Bitcoin rewards. Today, mining is an industrial-scale operation, requiring specialized hardware, significant energy consumption, and strategic planning.

At the heart of Bitcoin mining lies the Proof-of-Work (PoW) consensus mechanism. Miners compete to solve complex cryptographic puzzles, and the first to find the solution earns the right to add a new block of transactions to the blockchain, receiving Bitcoin as a reward. This process requires immense computational power, driving the demand for specialized mining hardware, known as ASICs (Application-Specific Integrated Circuits). These machines are designed solely for mining Bitcoin, offering significantly higher hash rates and energy efficiency compared to general-purpose computers.

The cost of acquiring and maintaining these mining rigs represents a significant upfront investment. Prices can range from a few thousand dollars to tens of thousands, depending on the model’s hash rate and energy efficiency. Furthermore, the rapidly evolving technology means that older models quickly become obsolete, requiring miners to constantly upgrade their hardware to remain competitive.

Beyond the hardware costs, electricity consumption is a major factor determining profitability. Bitcoin mining is an energy-intensive process, and miners often locate their operations in regions with low electricity costs, such as Iceland or China (prior to its ban on cryptocurrency mining). The cost of electricity can significantly impact the overall profitability, and miners must carefully consider this factor when choosing a location for their operations.

The difficulty of mining Bitcoin also plays a crucial role in profitability. The Bitcoin network automatically adjusts the difficulty level based on the total hash rate of the network. As more miners join the network, the difficulty increases, making it harder to solve the cryptographic puzzles and earn Bitcoin rewards. This means that miners must continuously upgrade their hardware and optimize their operations to maintain their profitability as the difficulty level increases.

The fluctuating price of Bitcoin is another major factor impacting mining profitability. When the price of Bitcoin is high, miners earn more revenue from their rewards. Conversely, when the price is low, miners may struggle to cover their operating costs, leading to losses. This volatility highlights the importance of having a robust risk management strategy.

To maximize returns in Bitcoin mining, miners employ various strategies. One common approach is to join a mining pool. Mining pools combine the computational power of multiple miners, increasing the chances of solving a block and earning rewards. The rewards are then distributed among the pool members based on their contribution to the pool’s hash rate. This allows smaller miners to participate in the mining process and earn a more consistent income.

Another strategy is to optimize energy efficiency. Miners can invest in more efficient mining hardware, optimize their cooling systems, and negotiate lower electricity rates with their suppliers. By reducing their energy consumption, miners can significantly increase their profitability.

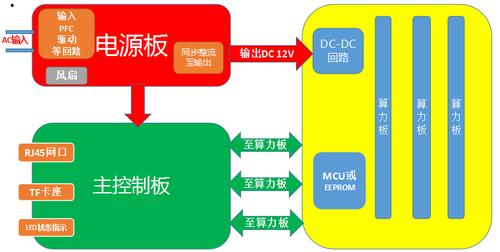

Mining machine hosting services offer an alternative for individuals who want to participate in Bitcoin mining without the hassle of managing their own hardware. These services provide a secure and reliable environment for hosting mining machines, handling maintenance, and ensuring optimal performance. This can be a convenient option for those who lack the technical expertise or resources to manage their own mining operations. These hosting facilities often house arrays of mining rigs, creating large-scale “mining farms.”

Beyond Bitcoin, other cryptocurrencies also rely on mining. Ethereum (ETH), before its transition to Proof-of-Stake, was a prominent example. Dogecoin (DOGE), known for its playful origins, also utilizes a PoW algorithm, relying on miners to secure its network. While the specific hardware and energy requirements may differ, the underlying principles of mining costs and profitability remain relevant across various cryptocurrencies.

Finally, navigating the complex world of cryptocurrency exchanges is essential for miners. Exchanges provide a platform for buying and selling Bitcoin and other cryptocurrencies, allowing miners to convert their rewards into fiat currency or other digital assets. Choosing a reputable exchange with low fees and high liquidity is crucial for maximizing returns.

In conclusion, Bitcoin mining presents both opportunities and challenges. By understanding the various factors that influence mining costs and profitability, miners can develop strategies to maximize their returns and navigate the ever-evolving landscape of the cryptocurrency industry. From selecting efficient hardware and optimizing energy consumption to joining mining pools and leveraging hosting services, strategic planning is paramount for success in this competitive and dynamic market.